How to read your 2022-23 Annual Member Statement

We know that annual superannuation statements can contain a lot of information, so we wrote this handy guide to help you understand the details.

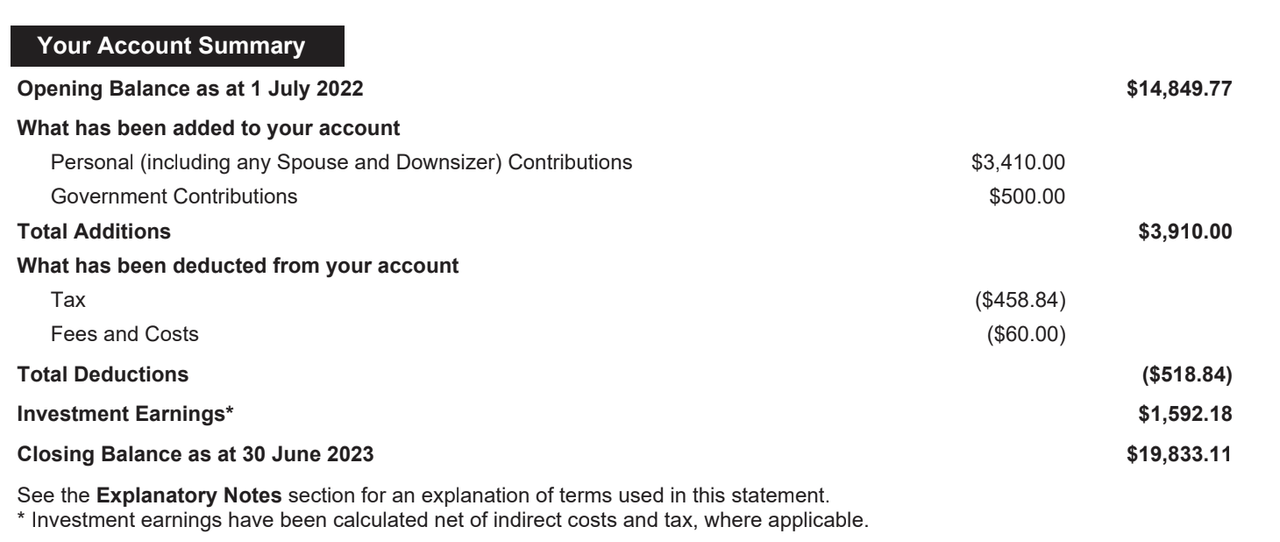

Your Account Summary

The annual statement is a summary of your account in the past financial year (from 1 July 2022- 30 June 2023)

The Opening balance is the balance of your account as at the start of the financial year on 1 July 2022.

What has been added includes funds allocated into your account. This includes things such as:

- Rollovers from other super accounts

- Contributions (including employer, person and government contributions)

- Tax rebates (you receive a tax rebate of 15% on direct fees deducted from your account). You can read more about this in your fees section below

What has been deducted from your account include deductions like taxes on your contributions, any benefits paid out of your account (such as withdrawals or rollovers), insurance premiums and direct fees.

Note, anything in brackets in a transaction listing here denotes a deduction or loss.

Investment earnings show the net return (or loss) for the year. This is the net movement in value of your investment over the year, less any indirect fees or taxes. (Read more about this below).

The Closing balance is the balance at the end of the financial year at 30 June 2023. Please note, this is not your current balance. To view your current balance, you can login to your online account or contact us.

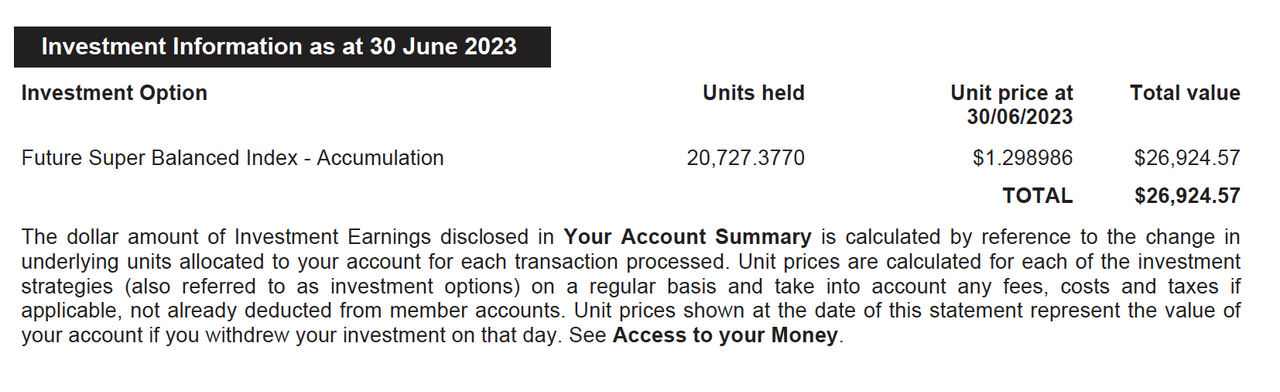

Investment Information

Units held means the number of units you own. Future Super is a unitised fund, which means that every time a contribution is made into your account, you are issued units in your chosen investment option. Your balance is therefore calculated as the number of units you hold multiplied by the unit price on any particular day.

Unit price is the price for all members of the fund (the value of a unit). The price is calculated every weekday and changes based on the value of the assets the fund invests in, as well as the fees and taxes that are due and deducted from the value of the assets. You can see the current and historical unit price for each investment option on our website here.

The Total value shown here is your balance as at 30 June 2023.

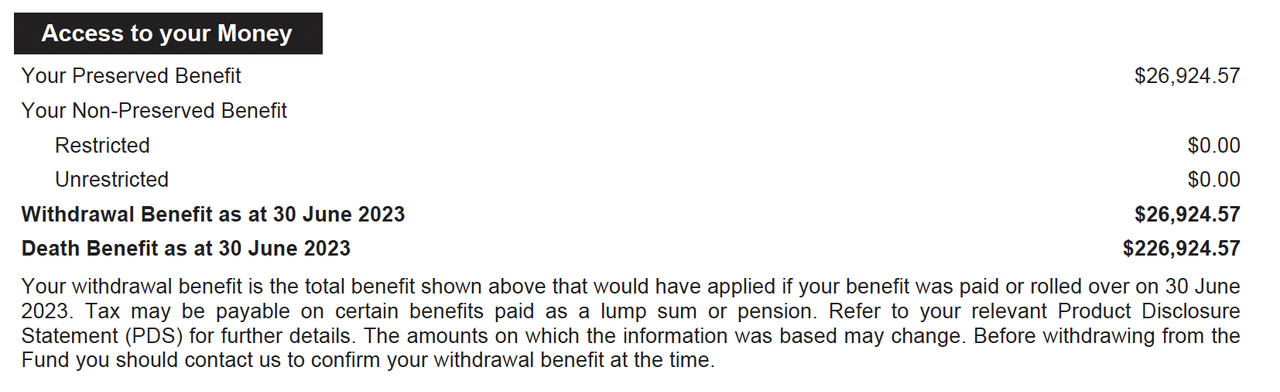

Accessing Your Super

Your account balance is broken into different components in the ‘Access Your Money’ section.

Your** Preserved benefit** means you can only withdraw this money if you meet a condition of release.

Restricted non-preserved benefits generally stem from employment-related contributions (other than employer contributions) made before 1 July 1999. You can access this component of your super if that employment has terminated.

Unrestricted non-preserved benefits are the funds in your account that you can withdraw without restriction.

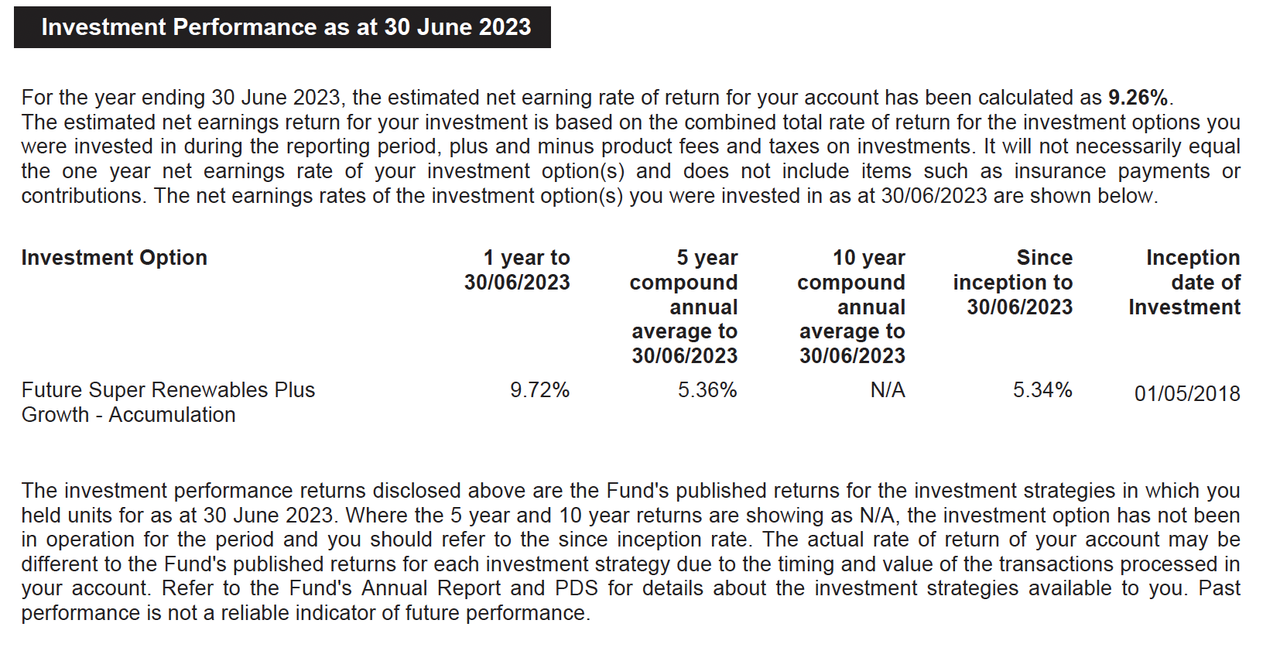

Investment Performance

Your investment performance is displayed after a deduction of fees and costs from your investment. This includes the asset-based administration fee (% fee), investment fee and taxes are deducted (more on this below).

This also means ourpublished fund returns are shown after those fees and taxes are deducted.

Your personal investment performance may differ to the fund performance depending on when you rolled in, and when and how much you contributed during the financial year.

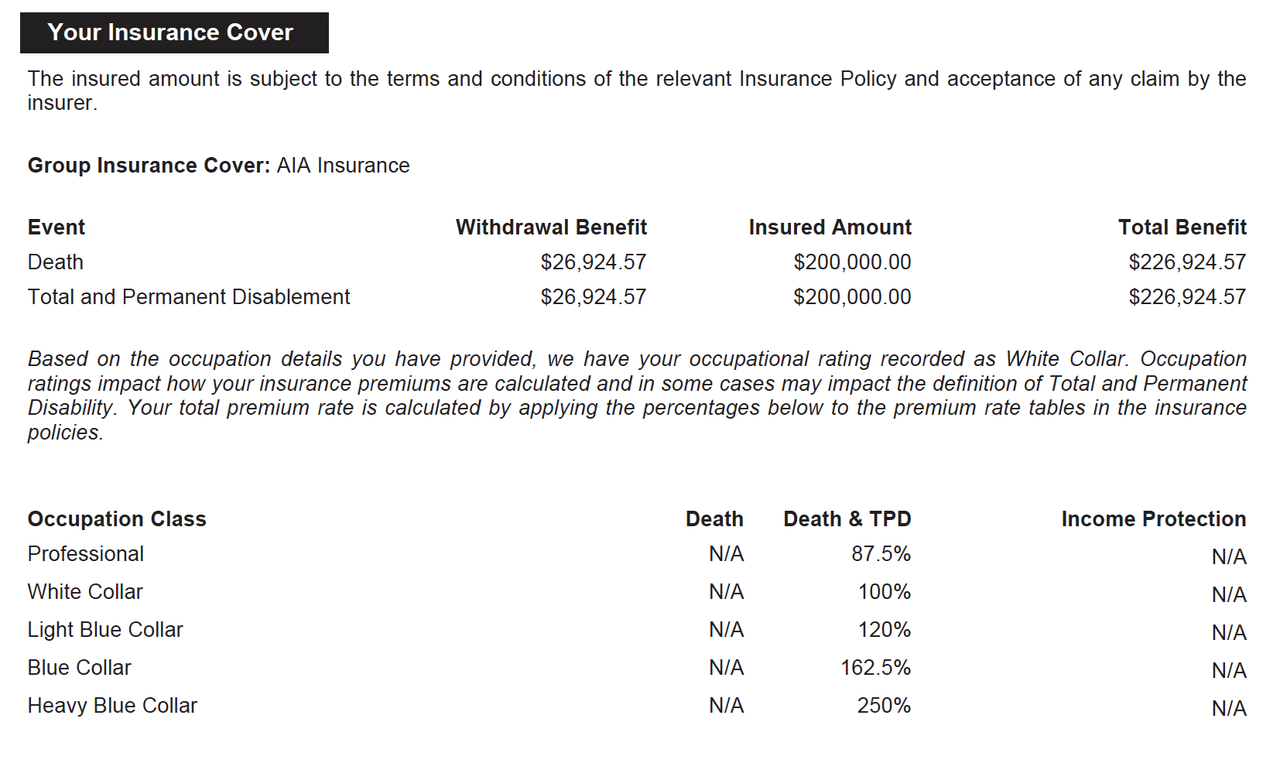

Your Insurance Details

If you have cover with us, it will appear in the Insurance Cover section and state your policy type and coverage amount. Future Super provides insurance on an opt-in basis only, i.e., we do not automatically provide members with default insurance.

The Withdrawal Benefit indicates the balance in your account that is available to withdraw in the event of your death or disablement. The Insured Amount is the amount your policy covers you for, this may either be the standard amount (if you applied via our easy opt-in method) or a customised amount chosen by you (if you applied via our voluntary method).

Please visit the Insurance section on our website to read more about the type of cover we offer. You can also see more information about your policy in our Insurance Guide.

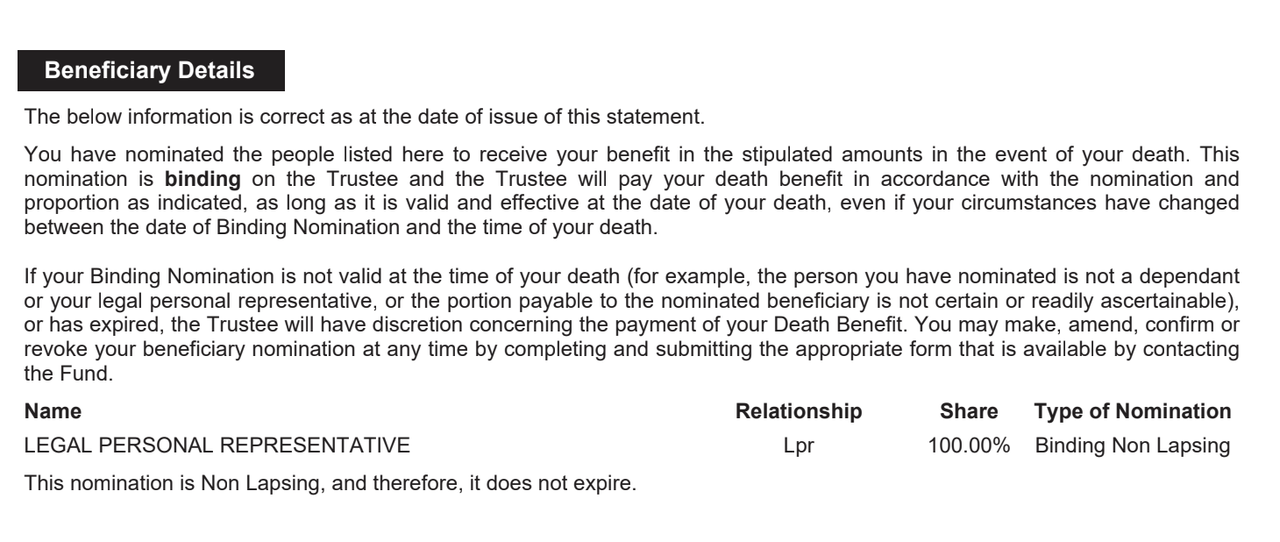

Your Beneficiaries

Beneficiary Details shows who you have nominated to receive a lump sum benefit in the event of your death. These nominations can be applied as binding or non-binding.

If you do not nominate a beneficiary, the Trustee of Future Super will have the final say as to who should receive your benefits.

You can read more about how beneficiaries work in our Additional Information Booklet.

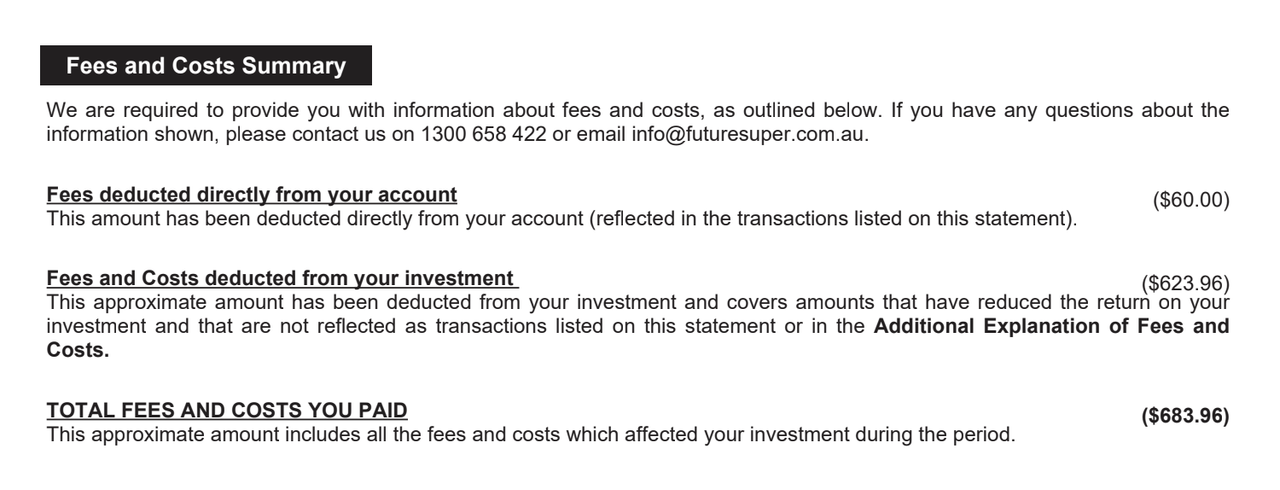

Total Fees You Paid

The total fees and costs you paid is made up of fees deducted directly from your account and the fees and costs deducted from your investment. This may differ depending on the investment option you have chosen to be in. A more detailed breakdown of fees can be found from pages 26-30 of the Additional Information Booklet.

The total fees and costs you paid is made up of fees deducted directly from your account and the fees and costs deducted from your investment. This may differ depending on the investment option you have chosen to be in.

Fees deducted directly from your account are the fees deducted directly from your account that appear in your transaction history. This includes the dollar-based administration fee.

Fees and costs deducted from your investment include most of your percentage-based fees are deducted when calculating your investment earnings figure. This includes the asset-based administration fee (%) and your investment fee. These don’t appear in your transaction history.

You can read more about how fees and costs are now displayed in our blog post here.

Please note, the way the fees are calculated and when they are applied differs depending on the type of fee, for more information refer to the relevant section in our Additional Information Booklet.

If you have any further questions you can find answers on our Support and FAQs page.

You can also email us at info@myfuturesuper.com.au or call us on 1300 658 422.

You should read the important information in our Product Disclosure Statement, Additional Information Booklet and Target Market Determination before making any financial decisions with Future Super.